As a member of ACG (Association for Corporate Growth) here inLos Angeles, we get a chance each New Year to gather and hear from a panel of experts on the cost and accessibility of money in 2012.

The event on January 4th was appropriately headlined too, The State of Capital Markets in 2012, and well attended with 3 panelists I really wanted to hear from. Jason Horstman Sr VP at Union Bank talked about Senior lending, Jeri Harman, a partner at Avante Mezzanine Partners focused on the state of Mezz, and Steve Wiesner Sr VP from Evergreen Pacific Partners brought the state of Private Equity into focus for us.

Most of the panel agreed that while 2011 was a tough year for getting deals done, all agreed the pipeline heading into 2012 looks real promising. A big lesson from last year to roll forward from what I heard was re-learning the definition of “early disclosure” (being transparent) from start to finish. In other words, as a business Seller or borrower much more scrutiny was placed on getting your dirty laundry out in the open up front, not somewhere in the process when due diligence auditors uncover the ugly stuff that can kill a deal. Likewise, bankers and buyers were expected to sharpen their pencils and perform their own enhanced levels of pre-qualification and preliminary due diligence before engaging a borrower.

This upfront accountability is not completely new, but there is a lot more emphasis on not passing the buck when new clients enter the process. This is why I always advise owners to never hide any issues and hope they get overlooked. Because they seldom do — and perhaps something that could have been resolved in the early going, looks worse when it’s uncovered by others later. Good way to kill your deal and your credibility.

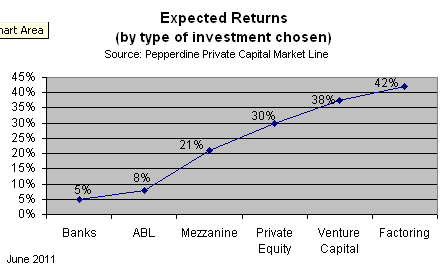

Most interesting to me from the panel was the discussion on current and expected interest rates for the type of money being borrowed or invested and the panel agreed, Sr lending rates are still low, but mostly for profitable businesses and owners who know how to manage through tough times. These rates according to Jason Horstman are still in the 3%-5% range for well qualified buyers, so to speak. The bank is eager to lend and expecting a busy year as conditions improve according to Horstman.

On the Mezzanine level where rates for unsecured debts are generally higher, the numbers to borrow came in as expected, in the low to mid teens, with leverage multiples (debt/ebitda) between 3x and 4x, not bad, especially if you need acquisition funding for a few years out. Jeri also noted an increase in ‘Unitranche’ deals. A Unitranche funding combines or rather blends a Sr lender’s (lower/secured rates) with a Mezzanine lender’s (higher/unsecured rates) all into a single lower rate, hence ‘uni’ trance rate. So let’s say you get a 5% Sr secured loan but need more. Adding a Mezzanine layer at 18% could be blended down to 10%. This is good news for many of you who may need both lending facilities to execute your 2012 strategy. The other interesting thing Jeri mentioned was an increasing level of respect and confidence lenders are showing to those business leaders who navigated the down turn. As conditions improve lenders are giving more credence to management teams that have proven they can manage the company in tough times, which is exactly what lenders feared most. This insight should give all surviving business owners more confidence this year to crawl out from their holes and borrow.

Lastly Steve Wiesner gave us the latest on the state of Private Equity backed funds going into 2012. As a buyer of business enterprises, Steve says buyers are paying higher EBITDA multiples for new acquisitions. This is in line with GF Data and other sources reporting EBITDA transaction multiples are back to pre-recession levels for firms over $50 mil in Enterprise Value, and not far behind pre-recession levels are multiples for firms under $50 mil EV. Steve’s bigger point may have been that we should expect to see less PE funds available overall in 2012 as 3-yr term vintage 2009 funds look to return un-deployed capital if the funds don’t find acceptable investment criteria targets soon. That’s the nature of the beast. But maybe less is better these days, you tell me.

In conclusion, the ACG event was a welcoming outlook to a growing optimism for the business funding environment this year. Whether you are making an acquisition, selling a business, or looking to raise capital, ‘advance preparation’ may be the new buzz words in 2012, or better could make the difference in closing your deal, on your terms.

Rick Andrade