The world of work has forever changed. Remote work is here to stay. And as a wave of younger workers refill the team ranks, data shows diversity (DEI) comes out on top. But while larger American businesses have already benefited, smaller ones with the most to gain are still dragging their feet. Why is that? Let’s have a look —

A lot has happened in the last 200 years! Think of it. In the early 1820s there was no electricity, no light bulbs, no automobiles, no steam locomotives, no telephones, no refrigerators, no microwave ovens, no internet, no cell phones, no social media and no Starbucks? My God! How did we exist?!

There was also something quite notably missing from the mix then, as now: there has never been a female President of the United States.

But just recently, despite the record heat of the season, global conflicts and fights against rising inflation if you pointed your compass due south of San Antonio, Texas about 650 miles, you will find yourself smack dab in the middle of Mexico City, Mexico, wherein something truly unprecedented in its 200-year history just happened this month.

The people of Mexico elected their first female president!

Her name is Claudia Sheinbaum (61), a Ph.D climate scientist and Mexico City’s former mayor with nearly 60% of the vote. A feat few thought would ever be possible before now.

And if that alone doesn’t ring your bell despite America’s own lack of diversity at the top, it’s the fact that her election occurred in a country of 130 million Mexicans, 80% of whom are catholic and dominated by a male machismo culture, and Sheinbaum is Jewish! Yup! You heard that right. Jewish.

Which signals to me and to all the world that old world traditions be damned, getting the best person to do the best job can be as easy as setting aside our biases and opening the door, and the ballot box to a new world of diversity possibilities.

Ok. So. Is this a fluke I wonder? Or is Mexico really onto something.

In what seems like forever the western world has been dominated by white men of power and prestige. And in its simplest terms the reason it stayed that way for centuries is the consequence of inherited group think, family, fear and bias.

It was then of little surprise that as businesses grew, owners and execs with similar backgrounds and education saw each other as among those best suited for the job, capable, and willing to follow their leader, so why not?

It made perfect sense to restrict acting authority to those few in trust. But that had consequences.

As power concentrated at the mountain’s peak, the ever-narrowing view of evaluating workers at the ground level consistently failed to see and recognize the abundance of unique talents there.

In my view the uncompromising victory of Claudia Sheinbaum is a welcomed big step in that direction. It sends all the right messages resonating around the globe that your background doesn’t matter anymore.

Diversity by design is the future.

The strategy, more commonly called DEI. Diversity, Equality and Inclusion goes right to the heart of our collective human potential when we decide to open our minds and our companies to those uniquely different from one another that can work together and perform at the highest levels.

DEI does have its critics. Some say it leads companies to a wholesale embrace of a “woke culture” consumed and transformed by cultural remorse for societies past transgressions and traditions. This “woke” intoxication is claimed to be an infectious company killer that must be prevented.

But I disagree!

Setting hysterical fears aside, DEI is not “woke.” Rather it’s simply an inclusive human strategy that should be viewed as a healthier contemporary 360-degree view from the inside of all the hidden gems available to scale a truly successful global business these days.

In fact, according to a recent Glassdoor employment survey conducted by The Harris Poll, 76% of job seekers say DEI is an important factor when applying for jobs.

At the same time, as younger workers enter the workforce these documented expectations illustrate the need for business leaders to adjust, and figure out how best to re-capture and re-engage their imaginations, especially for those who need more than a paycheck to set roots in a company long term.

In short, it’s more “wake-up call” than “woke-up company.” And it’s America’s many smaller businesses that struggle most with this view in my opinion, the very same companies that can benefit the most.

That’s why I wrote this.

I want to blow the “all-aboard” whistle for small business owners and CEOS in 2024 before the train leaves the station!

From my vantage point I see diversity by design as the key to unlocking the full potential of America’s small businesses. By fostering a culture of belonging and empowering diverse perspectives, these companies can tap into a wellspring of hidden creativity and problem-solving insights that have shown to create a distinct competitive edge, especially in a post-Covid remote worker world.

How do we know if DEI will pay off?

According to a 2015 McKinsey Study, it already has. Companies with diverse teams are 35% more likely to outperform their peers financially. Furthermore, organizations that prioritize inclusion are 2x as likely to meet or exceed their financial targets and 8x more likely to achieve better business outcomes.

When employees feel valued, respected, and empowered to contribute their unique insights, it fuels innovation, enhances productivity, and strengthens loyalty. Anyone reading this knows intuitively the power and production performance of a diverse team working together.

NASA for example has become a prized leader in showcasing what diverse teams can do, a far cry from its early days. Today the agency’s out-of-this-world accomplishments speak for themselves.

Meanwhile, Forbes magazine studied 1300 companies and ranked their DEI programs top to bottom for efficacy and results. But despite all the raging headline success stories, not enough smaller firms are in the mix.

Small business in the U.S. generate more than 40% of America’s GDP ($11 Trillion dollars). That’s a big target with deep potential.

What’s more, for smaller company owners the advantages of inclusive leadership can be even more pronounced according to Harvard Business Review.

By fostering a culture of belonging and empowering diverse perspectives, small businesses can more quickly gain competitive advantage, better understand the needs of their target markets, and attract and retain top talent from all corners of the planet– all critical factors for long-term success in a crowded remote-worker marketplace.

So, what’s not to like?

Articles, surveys, experts, research studies all conclude the same thing:

Successful DEI programs create diversity out of diversity:

- Developing new products that target new demographic markets such as movies, food, fashion and attractive nuanced services from hospitality to financial planning.

- Driving profits, improving operating efficiencies, lifting the bottom line, giving voice to marginalized workers whose innovative ideas are often overlooked.

- Providing a line-of-sight path for new employees and management teams to follow and embrace together as the company grows.

One small business example that caught my eye is from a fledgling food start-up called Hummii Snacks, a chickpea-based ice cream maker in Los Angeles, CA. whose CEO Tyler Phillips says; “One initiative we plan to roll out is to have each team member share and create their own flavor that represents their background.” How cool is that?

Only a small business can develop and get such ideas onto shelves quickly. I’ve seen this in many food companies I’ve consulted with over the years. Even a one hit brainstorm idea from an unexpected employee can launch a whole new line.

But for small businesses to cross the threshold we must foremost embrace and cultivate a culture of Belonging that lays the foundation and a new welcome mat for them.

I have written extensively about the American Dream and the recent challenges younger workers face finding a clear line of sight needed to achieving it.

And at the heart of it is that sense of belonging, the creation of a work environment where all employees feel this deep sense of family.

This goes beyond simply checking diversity boxes; it requires a concerted effort to ensure that every individual, regardless of their background or identity is welcomed, supported, and given a voice. We are after all at our best working as a collective hive, like happy bees making honey.

It’s about creating a psychological safety net that fosters open dialogue at every level. When people feel they can bring their authentic selves to work without fear of judgment or discrimination, they are more likely to take risks, challenge the status quo, and collaborate more deeply in ways that drive breakthrough innovations and solutions. And it works! At least that’s what the big dawggs in business have learned.

For smaller companies, cultivating a culture of belonging can be particularly impactful, as the close-knit nature of the workforce can amplify the effects of inclusive practices. By actively promoting open communication, celebrating diversity, and empowering employees to contribute their unique perspectives, small business owners and CEOs can foster a sense of community that inspires loyalty, creativity, and a shared sense of purpose.

And isn’t that the fundamental driver of American exceptionalism?

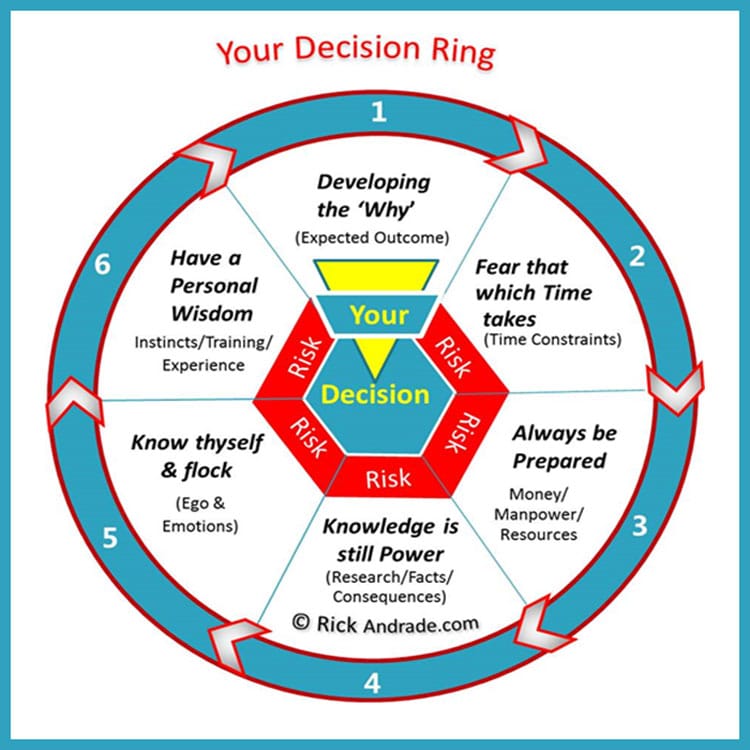

So, how do you build an inclusive team?

Achieving true inclusivity requires a multifaceted approach that spans the entire employee lifecycle.

This includes implementing unbiased hiring and promotion practices, providing unconscious bias training, and developing mentorship and sponsorship programs to support the advancement of underrepresented groups. There are dozens of consulting experts in Human Resources that can help you get started. Because, “It’s not enough to simply hire a diverse workforce,” experts caution. We must also ensure that these employees have equal access to opportunities, resources, and pathways for growth.

This is where inclusive leadership truly shines.

By actively championing and advocating for marginalized voices employees will soon get the word out, music to the ears of the 76% of Glassdoor job seekers looking for the way in.

So, how do you know if your company can benefit? Test them!

For example, casually ask random employees which two holidays are most important to have off? If most answer the 4th-of-July and Christmas, you can likely bet you’ll benefit from a DEI strategy. Remember: asking is learning.

That’s the key message here.

So – if nothing else remember this.

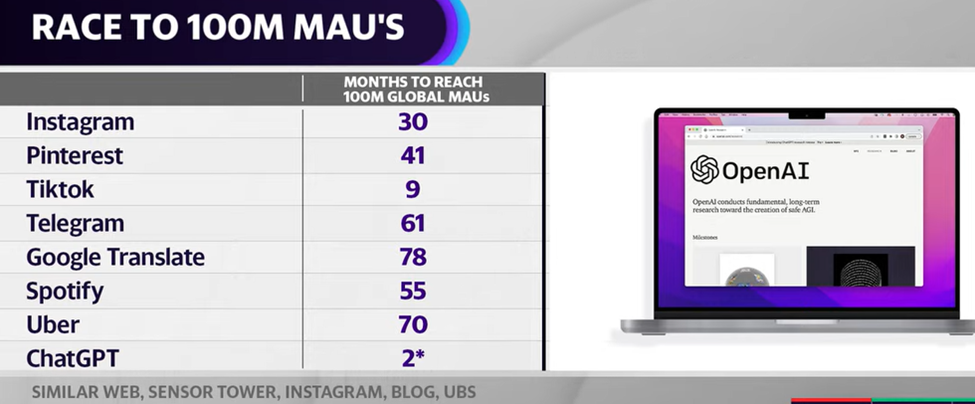

In a post-Covid world the nature of work and working together as a team has drastically changed in the last 4 years. And in an era of rapidly changing technology including AI advancements, shifting societal expectations, and heightened competition, DEI offers America’s small business leaders a chance to board the train in front of them, and harness the power of diverse perspectives as a strategic imperative, or risk a competitor that puts you out of business.

So be a proactive executive!

Loosen the reins and take bold proactive steps to cultivate a DEI culture that can become the beating heart of your company’s competitive edge, one that will thrive on embracing the power of inclusive belonging and diversity by design.

And the good news is that unlike the pace of change in American politics it shouldn’t take us 200 more years for us to figure it out.

And that as the famously followed Martha Stewart used to say is “a good thing.”

Rick.