10 WAYS TO BOOST YOUR COMPANY’S VALUE

Practice #10: Review your Capital Structure

As you may know, Capital Structure is how a business finances itself using debt, equity, or other securities like bonds, etc. The key question I am often asked is “what is the best capital structure for my business?” The answer in part depends on which industry you are in, and if you are a ‘mature vs growth’ company in that industry. In either case it is important to make sure you are operating within typical industry guidelines for debt vs. equity ratios of comparable firms. If most companies in your industry have 40 percent debt on the books and you have 70 percent debt, your valuation could suffer even though your cash flows can meet interest obligations. Bankers, buyers and investors love to see standard metrics balanced across debt vs. equity in order to compare your firm’s future prospects with best in class companies in your industry.

As a result, business owners at all levels that try to maximize shareholder investment, do so generally by reducing their “Cost of Capital” which means that Debt as opposed to Equity is cheaper to finance operations and growth. The cost of debt is the interest rate, while the cost of equity is harder to calculate (using CAPM etc) but is generally the expected return your investor would have of a similarly risky venture. In most cases, making an illiquid investment in a middle market private company is considered a more risky investment, hence higher expected return (rate).

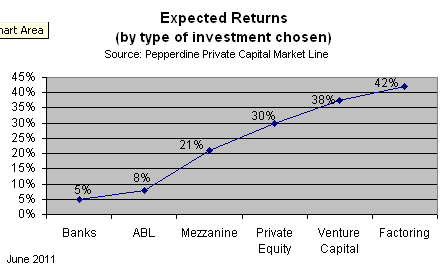

The easiest way to see this in action is to compare several types of funds by their costs of capital expected rates. Dozens of studies and analyses can be found that identify the cost of various capital options. One analysis by Robert Slee, professor of finance atPepperdineUniversitydelineated several types of capital you can choose from and the expected rates of return associated with each in the chart below. The chart includes typical costs of capital for Bank Loans, ABL (Asset Based Lending), Mezzanine Lending, Private Equity, Venture Capital, and Factoring as of June 2011:

As you can see, with the exception of Factoring, the cost of capital (expected return rates) increases as business owners move from lower cost bank lending on the left side to higher priced equity and venture capital investments on the right. Of course all companies want a lower cost of financing, however, while equity requires no monthly interest payments, the overall cost of selling (issuing) equity is higher. Hence the ideal Capital Structure is some combination of debt and equity. And by maximizing the cost of capital for your company you can improve the overall valuation of the firm. Conversely a lop-sided Capital Structure can reduce the value of your company when compared to a more efficient competitor in the industry.

If you don’t know which type of investment is best to fund your company, it is always best to consult with your commercial and investment banker for advice. Let them run the calculations for your specific firm lay out the options. Remember; your target Capital Structure should be similar to industry benchmarks or better if possible.