We all know the statistic. Ten thousand Baby Boomers turn age 65 each day according to the Pew Research Center. And of those many thousands who own businesses, a day of reckoning is coming.

Do you know what the leading concern is among wealthy Americans heading into retirement? It’s not growing their wealth for the future; it’s preserving their wealth for family and philanthropy. Sound familiar?

If it does, and you own a business, you will likely leave money on the table when you sell or exit the business unnecessarily, why? Because most business owners don’t really know how a buyer thinks, and how they value the individual pieces of a business. Consequently, as each piece is measured and evaluated, the chances of finding weaknesses that can lower the value of the business grows. The more weak spots identified, the greater the gap between buyer and seller.

But there is good news. Business owners can narrow the divide before a sale if they learn how to “prep it before you exit.” Here’s how…

As we know, the first stop in any good exit plan should include your wealth planning and estate professionals. While most can offer dozens of ways to grow your post-sale proceeds in a retirement plan, that still leaves a huge need to help business owners identify weak spots that can reduce the value of their business “nest egg” before a buyer does.

And just like developing a financial planning retirement roadmap after the sale of a business, the best way to uncover value-drains in your business is to prepare a Pre-sale Business-(performance) Review. This way, while you’re still in control of the business, you identify and fix problem areas before you do decide to go market.

What’s in a Pre-sale Business Review?

The first thing to understand is that, like buying a house, the price or value of the property is only partly based on market conditions, the other part is “in the eye of the beholder.” This means that despite market trends or conditions, you and a best-fit buyer might not see eye-to-eye on the value of your business. And that is a bad place to start negotiations for more. If a big chunk of business valuation is “perception,” for a business to sell at a premium price it needs to truly demonstrate today a compelling ability to stay competitive and increase profits in the years to come.

How to identify Pre-sale weaknesses

The important direction of any Pre-sale Business Review is to identify and document the key value drivers that make your business profitable to buyers, and the risks, or obstacles that challenge the business going forward. Below are 5 time-tested Pre-sale Business Review methods that can help:

- BCG Matrix: This matrix developed by the Boston Consulting Group decades ago is still a useful tool today to help breakdown and position a company and its products within one of four quadrants: a Question Mark, a Star, a Cash-Cow, or a Dog.

Nearly any business, division, product line, customer segment, etc, or an entire industry can be measured and placed somewhere on a BCG matrix like this one. But while the exercise is quick and easy; the results are hard to change quickly. This is why if you find something you own is a DOG, unless it’s fury with four legs and a tail, it needs to go. Investment time, money, energy resources, you name it should all focus instead on sustaining high margin products or services, like Stars, while forcing all Dogs and Question Marks to beat their cost-of-capital to survive. Taking this action before taking your business to market can substantially improve a buyer’s perception of value.

- Quality of Earnings Report: While having fully audited financial statements is a best practice 3 to 5 years leading into a business sale, another less costly measure is a Quality of Earnings Report. Most accounting firms that do Audits can also do a QE analysis. In fact, a significant component of a sophisticated buyers Due Diligence investigation of a targeted acquisition is a detailed review of earnings and expenses. But most business owners don’t engage a firm to conduct a QE. Owners don’t see the cost/benefit until it’s too late. However, a well done QE report will explain where a company or product should be placed on the BCG Matrix. And taken together the BCG Matrix and a QE report can thus specifically help a business owner (years in advance of a sale), identify and nurture strong revenue drivers, while shedding the weaker ones that influence a buyer’s perception of value.

- Management Team SWOT: Strengths, Weaknesses, Opportunities, and Threats make up a SWOT analysis. The idea behind a SWOT analysis is to breakdown and categorize the key characteristics of any organized system into four groups. While similar to the BCG Matrix, SWOT also identifies both internal and external issues facing a business. In this case a Management Team SWOT summary can flush out areas where Huma

n Resource investments need more attention. For example, is a lower performing corporate division a result of a poor product line, or poor management skills? A buyer could easily ask you or your investment banking team for a senior staff SWOT analysis during due diligence. But why wait until then? Do a Management Team SWOT now, in advance of your exit. Be honest with key staff, and be ready to make changes now while you are in control. Most buyers will look to weigh the pros and cons of your management team’s skillsets heavily in their value calculation of your business.

n Resource investments need more attention. For example, is a lower performing corporate division a result of a poor product line, or poor management skills? A buyer could easily ask you or your investment banking team for a senior staff SWOT analysis during due diligence. But why wait until then? Do a Management Team SWOT now, in advance of your exit. Be honest with key staff, and be ready to make changes now while you are in control. Most buyers will look to weigh the pros and cons of your management team’s skillsets heavily in their value calculation of your business.

Top-drawer sellers know the contribution margins of their key managers. But many other business sellers don’t, and that can result in a major discount to value on exit. So take the initiative and implement a Management Team SWOT program that incentivizes leadership, sales growth, and customer satisfaction. The folks at White Rock Consulting for instance took a deep dive on Personal SWOT analysis which gives you a good idea of how to measure executives and staff strengths and weaknesses before letting a buyer surprise you to the downside.

Most importantly included in a Management Team SWOT analysis will be the big question. Who will replace you, the owner? And how will that person likely perform? Grooming younger managers to step up too quickly can be a costly mistake. Most buyers want a high performing team, and when they find one, they are generally willing to pay up to keep them. So make changes far enough in advance of your exit to allow key managers a chance to perform at industry-best levels.

- Executive Dashboards: Tracking Performance Metrics has always been a significant use of resources. Regardless of how many years away from retirement you are consider implementing an

Executive Dash Board (EDB). This does not have to be an expensive software commitment. But by having a robust and accurate EDB process alone indicates to buyers your commitment to knowing your numbers. This includes having access to data a few clicks away such as EBITDA margins, gross margins, product margins, inventory turns, customer turns, and budget forecasts. Each industry has its own set of common benchmark performance metrics that it values most, and a buyer will know them too. Even more, a buyer may know your competitors’ performance metrics and how they benchmark against “best practices” in the industry. A good EDB software package is well worth the investment pre-sale because it can track (in near real time) dozens of KPIs (key performance indicators) and can help executives make better decisions more timely and effectively. If you already have an EDB your company is already ahead of the game, and can be perceived as having a higher value.

Executive Dash Board (EDB). This does not have to be an expensive software commitment. But by having a robust and accurate EDB process alone indicates to buyers your commitment to knowing your numbers. This includes having access to data a few clicks away such as EBITDA margins, gross margins, product margins, inventory turns, customer turns, and budget forecasts. Each industry has its own set of common benchmark performance metrics that it values most, and a buyer will know them too. Even more, a buyer may know your competitors’ performance metrics and how they benchmark against “best practices” in the industry. A good EDB software package is well worth the investment pre-sale because it can track (in near real time) dozens of KPIs (key performance indicators) and can help executives make better decisions more timely and effectively. If you already have an EDB your company is already ahead of the game, and can be perceived as having a higher value.

- Document Key Processes: Anything that makes it easier for a buyer to acquire, manage or integrate your company into theirs is a value-driver. But sadly, in many cases smaller company

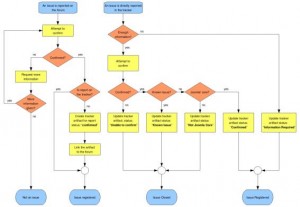

owners don’t document key process steps. Most don’t know how important this value-driver really is. And for these owners the risk of losing money increases everyday as key staffers who quit, can take an undocumented best practice process with them. This is very common and owners should be advised to create work manuals and map all process steps far in advance of a sale. Doing so will give buyers the confidence needed they can repeat your processes and grow profits into the future.

owners don’t document key process steps. Most don’t know how important this value-driver really is. And for these owners the risk of losing money increases everyday as key staffers who quit, can take an undocumented best practice process with them. This is very common and owners should be advised to create work manuals and map all process steps far in advance of a sale. Doing so will give buyers the confidence needed they can repeat your processes and grow profits into the future.

Lastly, while most sellers already know the key value-drivers in their business, most will still benefit separately by taking the time to measure the future today using a Pre-sale Business Review that includes these time-tested strategic tools. The important thing here is to key in on the value-drivers that buyer’s in the market are looking for in order to grow and perhaps double sales in as little as a couple years. So ask yourself…Is my business ready to be sold just because I am ready to sell it?

Your investment bankers who are active in the market will better know which performance and profitability metrics come first in the eye of buyers. So seek their advice, because if you are among the thousands of baby boomer business owners turning age 65 every day in 2016, the benefits of a few simple tools in a Pre-sale Business Review can substantially increase the amount of cash you take with you on that day of reckoning. Make sense?

———-

About the author: Rick Andrade is an investment  banker at Janas Associates in Pasadena, Ca and finance writer in Los Angeles helping CEOs buy, sell and finance middle market companies. Rick has earned his BA and MBA from UCLA along with his Series 7, 63 & 79 FINRA securities licenses. He is also a Real Estate Broker, a volunteer SBA/SCORE instructor, and blogs at www.RickAndrade.com on issues important to middle market business owners. He can be reached at RJA@JanasCorp.com. This article is for informational purposes only and should not be considered in any way an offer to buy or sell a security. Securities are offered through JCC Advisors, Member FINRA/SIPC.

banker at Janas Associates in Pasadena, Ca and finance writer in Los Angeles helping CEOs buy, sell and finance middle market companies. Rick has earned his BA and MBA from UCLA along with his Series 7, 63 & 79 FINRA securities licenses. He is also a Real Estate Broker, a volunteer SBA/SCORE instructor, and blogs at www.RickAndrade.com on issues important to middle market business owners. He can be reached at RJA@JanasCorp.com. This article is for informational purposes only and should not be considered in any way an offer to buy or sell a security. Securities are offered through JCC Advisors, Member FINRA/SIPC.