Last month E&Y reported a near 50% drop in global M&A from $4Trillion in 2007 to $2Trillion last year, and while that may not be a fair comparison as M&A crawls back from the depths, the perennial fear and anxiety buyers have of overpaying for mergers and acquisitions has probably never been higher. Often missing is the acquirer’s ability to accurately measure the value of the Seller’s customer base and its recurring revenue streams.

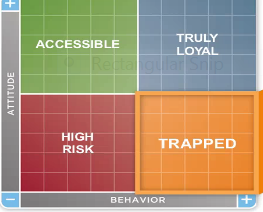

The reason for the error according to Walker Research, an Indianapolis based customer research firm, is the acquirer’s inability to properly survey the top 80% of the Seller’s customer base and categorize them into 4 Key Value groups:

Properly identifying the “customer type” and matching it up with the likelihood that those customers will stick around can help avoid overpaying for an M&A target sometimes by $millions. The simple rule of thumb or takeaway is to recognize when you the CEO of the acquiring company may need to hire a 3rd party to re-evaluate and re-value the Seller’s customer base more closely in a riskier transaction.

Walker Research recently gave members of the ACG (Association for Corporate Growth) an informative webinar explaining the importance of Advanced Customer Due Diligence – which is now available to the public.