November 2020 – As published by CEOWorld Magazine

They say that in late November 1621 in Plymouth, Massachusetts the first American Colony held the first American Thanksgiving to celebrate a bountiful harvest with the local Wampanoag Indian tribe. What you might not know is that of the nearly 100 who attended the first feast only 4 were women settlers. The reason so few attended is tragic and reflective in a modern Covid world. Of the 20 women Pilgrims who gallantly made the trip across the Atlantic to Plymouth on the Mayflower in 1620, all but these last 4 succumbed to either starvation, harsh winter cold, or more familiarly an infectious viral plague that struck the colony the year earlier. Still the idea to eat well and give “Thanks” after such an ordeal set promise to a brighter future in honor of those sacrifices, and to covet God’s word in scripture across much hope and prayer.

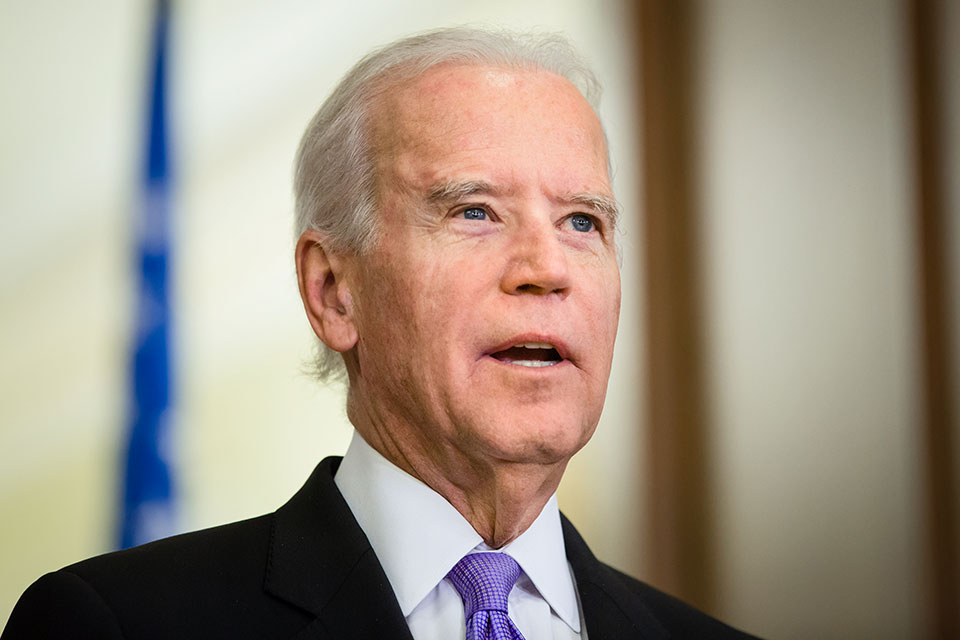

Today, 400 years later this Thanksgiving 2020 finds us all adding a bit more hope and prayer to the menu but this time we not only face a long cold winter and virulent plague, but also the dire prospect of a new plethora of increased economic pressures from a Democratic Party new president. Sound too harsh? Depends on which side of the fence you’re on. But if the electoral votes from each state are indeed certified accurate, Joe Biden is our next president, the 46th. And should that be the case, and a left-wing anti-business agenda takes hold of the U.S. government, the next big question from business owners and investors alike will be: Yikes! Now what…?

Like others before him President-elect Biden carries with him a full bag of sweeping democratic changes he wants to implement across the board including the Green New Deal, Medicare For All, and new Taxes.

For starters however, the first priority will be how to manage through the Covid pandemic. As cases surge across the country so does the race to roll-out two new vaccines each with 95% effective rates. My hope is that Biden who has been a politician all his adult life does not shut down the economy which in my view amounts to economic mass suicide.

The second will be Biden’s executive actions January 20th 2021, day-one. Recall the hundreds of Executive Orders issued by President Trump. Many orders changed industry regulations across the table including in politically sensitive areas like global warming, U.S. military engagement in the mid-east, fracking in Pennsylvania and lobster fishing in Maine. Dozens of changes made under Trump could easily be reversed under Biden with the stroke of a pen. But perhaps the biggest impact to small and medium size businesses that survive Covid through next year will stem from increased taxes and changes to healthcare coverage.

Business Taxes – Under a President Biden the proposal on the table is to roll-back the Trump tax cuts and increase them from their current 21% back to 28% according to the latest report from the not-for-profit Tax Foundation.org.

Personal Income taxes – Top bracket personal income tax rates are expected to increase from 37% back to 39.6% on income over $400,000, with few places to hide. Moreover, the plan in fact according to the Tax Foundation would actually reduce after-tax income for the average American worker by 2% by 2030. And while these are just the high-level figures, it gets much uglier if the Senate majority flips from Republican to Democrat (see Jan 5th 2021 Georgia Senate run-off race).

Capital Gains tax – The Biden plan will nearly double the tax on long term capital gains from 20% to 39.6% on income over $1 million (add another 3.8% net investment income tax if your adjusted gross income tops $250,000 for married couples). The Foundation also notes that raising the capital gains tax is less likely to increase federal revenues rather it will likely delay the sale of those assets until taxpayers find a less costly method. As a result, if the long-term capital gains tax rates do double as proposed the Tax Foundation further calculates an actual loss of $2 billion in annual revenues to the government, making this a bad idea.

Estate & Gift Taxes – Under Trump’s Tax Cuts & Jobs Act the gift & estate tax exemption threshold was $11.5 million for singles and $23 million for married filers. That will change. Under a Biden plan a dramatically lower exemption threshold for the first $3.5 million and a whopping 45% tax on assets above that is being proposed. Notwithstanding the step-up in “basis” the value after which a tax is imposed is eliminated, meaning new estate owners will pay higher taxes on the current market value of their assets. Yikes… Should democrats win a majority in Congress… it will be open season for Wealth & Estate planners to come door knocking, and rightfully so.

Employee Health coverage – The Affordable Care Act (ACA- Obamacare) The Public Option – In 2019 the Census Bureau reported an estimated 30 million in the U.S. were without healthcare. These figures among others have compelled the Biden-Sanders task force to propose that the U.S. government take center stage and majority control over citizen healthcare. Essentially the Biden plan wants to socialize medicine in the U.S. similar to Senator Bernie Sanders’ “Medicare for All,” while leaving in place private health insurance. The key changes will expand the ACA to allow everyone including undocumented workers access to federal premium subsidies to acquire health insurance on the ACA provider websites. The Biden plan also proposes to reinstate the “individual mandate” (case to be heard by the Supreme Court this winter) which was eliminated by the Trump administration, however at the same time the Biden plan will also increase federal subsidies to the poor who can’t afford it. Biden says the new ACA will cover an additional 25 million of the 30 million people uninsured.

But to make this all happen the Democrats would need to negotiate with a Republican Senate, unless the expected Senate race run-off in Georgia January 2021 as mentioned flips the Senate to a Democrat majority. What this means for small business and all business is obvious to me. Changes in healthcare are inevitable and usually end up costing small business owners in one way or another. In this case putting pressure on private insurance plans to stay competitive absorbing pre-conditions and doctor choice in the face of a giant new government-sponsored health system. This may leave many small business employers who like their current health insurance plans and who wish to keep high employees happy in the lurch with higher premiums, and with fewer affordable competitive private insurance plan choices than before.

Employee Minimum Wage – Under the Biden team economic plan there will be a strong push for a national minimum wage increase to $15/hour over the next few years. This despite outcries from small business owners in lower wage U.S. states and many economists who argue raising minimum wages will increase the burden on struggling small business profits creating fewer job openings at a time when we need more of them, not less.

And Finally: First things first – Where is the next Covid Stimulus & Response package?

As of mid-November, the outlook for a Covid vaccine has abruptly improved given both bio firms Pfizer and Moderna each separately announced their vaccines are ready, and are nearly 95% effective. Each compliments Trump’s Operation Warp Speed initiative for getting us to this point. Meanwhile, post-election there remains little evidence of yet another helping tranche (aka 4th stimulus package) estimated at another $2 Trillion including supplemental employment benefits, recovery rebates, and the popular PPP (Paycheck Protection Program) is emerging from Congress or the White House, as shutdowns loom and millions of small businesses and workers are still suffering this Thanksgiving. This makes welcome the spirited news that a Covid vaccine distributed over the next 6 months will likely help stem the tide of increasing Covid infections. Still, it seems unlikely any stimulus plan will get passed in an upcoming lame-duck session. But the general consensus among most reports is that Democrats are preparing a new measure that will be ready in January for the Senate and President Biden to sign, which unfortunately may be far too late for many businesses on the rocks and needing help.

Summary – Impact under Joe Biden

It seems almost inevitable that personal taxes, business taxes, capital gains, and estate taxes are all going up to some degree under a Joe Biden Presidency. Many promises were made, and new taxes appear the only way to pay for them. But that won’t happen until new laws are debated and passed next year. The good news is that in most cases any tax increase will not be retro-active giving you some time (likely until June 2021) to calculate the impact and make hard decisions. Many businesses may not survive Covid this winter, especially if harsh federal mandates further restrict business activities and push fragile business owners into a fatal financial tailspin. Other long-term asset owners will need to reshuffle their retirement plans including when and how to sell assets, transfer equity in a business, or cash out now and benefit from today’s substantially lower rates.

In either case, the key message is not to sit on your hands. These proposed Biden team tax increases if left unplanned for in the coming months could amount to tens of thousands or millions of dollars in added tax burdens for you or your heirs. My advice? Have your feast, but don’t get caught on the wrong side of the plate. After you read this, push back from the turkey table, grab your phone and schedule a call with your tax advisor, estate advisor, or wealth advisor. You’ll be glad you did.

And lastly, if you own a business and need advice on buying or selling call a trusted investment banker, he or she can help talk you through some of the options we are seeing in development and what other business owners are planning to do before year’s end. Getting professional advisors on board now can help you navigate the landscape well before the cold Biden left-overs leave you with a bad taste in your mouth.

Make sense?

Written by Rick Andrade.