Eh! It’s 2014: Show me the Money, Jerry

February 13, 2014 • Rick Andrade • Print

published: Vistage for CEOs

“Show me the money,” shouts a screaming football player (played by Cuba Gooding Jr) into the phone to his sports agent Jerry Maguire (played by Tom Cruise) in the movie. The scene is forever classic, like “Greed is good” in the movie Wall Street. But here, Jerry must bellow back the phrase over and over to salvage Gooding (his last remaining client) from jumping ship.

While it may be hard to recall the exact year that movie was released, the line and message has never lost its popular refrain. Show me the money. That’s still the big question I hear in these early days of the New Year from small business owners sensing it may be safe to invest in the future again.

While the economy hints at really blasting off in 2014, a new hope for better times ahead is finding its roots in many quarters of the economy, according to economists like Mark Zandy at Moodys. Zandy sees the December labor report which showed only 74,000 new jobs created as a flute, and sites a 4% GDP run-rate in Q4 of 2013, coupled with a 30% increase in the S&P stock index last year, as too bullish to ignore.

To these enthusiasts, 2014 is finally the year to Show me the Money. Translation; we should expect more growth, more demand, more jobs, and less government intervention. But I can recall a year ago January 2013 when much the same enthusiasm lauded 2013 as the break out year. But while the stock market (courtesy of the Fed) added 30% gains, money lenders and investors showed only a weary confidence. So why should we believe now 2014 is the new 2013?

As a natural born sceptic, always on the alert, I tend to look for signs that the engine that drives our economy is truly gearing up, which means more specifically, not looking at employment figures up or down each month, but rather taking a closer look at small business lending metrics as a leading indicator, in other words checking the horse behind the horsepower. Companies who borrow do so because they see a profitable reason for doing so.

Still, from the executives I speak with, as a business and banking advisor, comes a repeated chorus of rhythm and blues as to why banks still won’t lend to them. But the reality, according to the Federal Reserve October Bank Lending Survey, is different. “Regarding loans to businesses….banks eased their lending policies” and sited an increase in demand and competition for such loans. The market for business loans and equity capital funding has been quietly fertilizing the landscape for small business growth for months now, which I believe is why the stock market and economic forecasts look so much more promising.

If the trend continues as expected, Show me the Money for businesses large and small will flow like the river Nile in 2014. In fact, a recent KPMG survey of 1000 business execs found 2 out of 3 (66%) are looking for new opportunities to expand in 2014, including in my space, bringing buyers and sellers together in M&A.

Like no other time in history, access to capital is global. What’s more, while the landscape of capital providers continues to change, competition among money lenders and investors is expected to heat up this year as idle cash seeks solid investment opportunities. What’s especially good about 2014’s ability to really Show me the Money is a consequence of the JOBS Act two years earlier. New SEC rules now allow more general public solicitation for investments formally excluded, which opens wide the capital flow spickit even more than in 2013, making it easier for private equity funds, hedge funds, and even venture capital rounds to advertise and raise money via the internet.

Add to that, courtesy of Title III of the JOBS act, Crowdfunding, which connects small business and/or entrepreneurs with like-minded investors online using social media. This new funding platform has already topped $5bil in deal activity last year according to www.crowdfunding.org, and in my view will soon compete aggressively and openly with Angel and Venture Capital group money.

Which brings me to the key question I am often asked: “If there is so much money, where is it? “

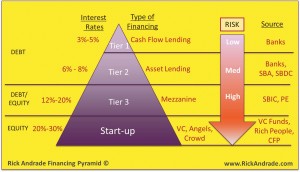

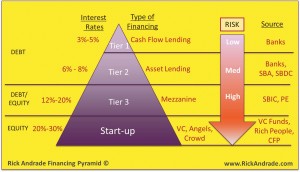

see pyramid graphic

Enter the Rick Andrade FINANCING PYRAMID, a simple graphical way to visualize how lenders and investors categorize and link risk to rates. I recently discussed a version of my Pyramid as a speaker at the Fancy Food Show in San Francisco this year. I created the Financing Pyramid because it helps explain why applications for loans or equity get rejected. Here for the first time business owners and execs can see how banks and investors will likely view applicants when they ask for cash. And unless your company is a Tier 1 borrower, the unexpected higher interest rates quoted can be hard to understand. Why?

The simplest answer when clients ask what rate a lender or investor will charge is to know what risk they are taking: the lower the risk the lower the rate. Have a look at the Pyramid again. Interest rates listed are near-term ranges from surveys and vary according to the applicants perceived risk profile; like home mortgage loan rates that can vary based on your credit score.

On the right hand side of the Pyramid are the sources of financing like commercial banks, small business investment companies, private equity, angels and even crowdfunding. This is where so many execs get confused and often shocked out of the market when they approach a source for money. They hear about low rates and abundant capital, but don’t know in advance which Pyramid layer (interest rate group) their application will fall, or should fall: Hence why I created the Pyramid.

In Tier 1, top earning cash flow businesses which are mostly mature, profitable businesses looking to borrow funds to expand via M&A, build new plants and buy new equipment get the best deals because the risk of repayment default is low. That’s easy, right? But higher risk Start-ups on the other hand, trade risk for reward more starkly. In 2014, rates for HIGH RISK start-ups will likely stay in the 30-40% range, where they have been historically, because the risk of default is most often very high.

50% of all new start-ups will fail within 5 years according to the BLS. For this reason, banks and other lending institutions want collateral and security for defaults. Enter Tier 2, where lenders look for assets and accounts receivables to collateralize in the absence of abundant cash flows. These Asset Based Lenders, and hard money finance companies like On Deck, Biz2credit, and CAN Capital to name a few charge hefty fees, as high as 50% annualized, according to the Wall Street Journal (1-8-14, 2014).

Still without such collateral the risk of default climbs even more in the eyes of many money sources. And at Tier 3 & 4 (Start-Ups), it’s hard to fill the void. Family, Friends, Angels, Credit Cards, these old traditional sources of funds have not changed in decades. And rates for these funds, in some cases 40% or more, may even require business owners to use the equity in their business in exchange for the cash.

The take-away message here is that while investors and lenders have more Show me the Money capital on-hand ready to deploy now than at any time since the great recession ended. 2014 still requires the responsibility of business owners and cash-seeking executives to calculate their own risk profile. Do the research and peg your risk profile with those on the Financing Pyramid.

When you do that, you will have at the very least a basis of understanding for why lenders and investors when they do Show you the Money, will charge you, not the advertised media headline super low promotional rate, but rather the rate that matches the reality.

In Finance