For some it’s a new day, for others the smell of fear lingers on more than 7 years past the Great Recession when life changed in America. Back then the pace of global M&A was approaching $4 Trillion, today it’s half that. But like all cycles long or short things come back around and when they do, it’s no time to hide behind a pumpkin in the dark. According to Mergers & Acquisitions News, many fearless middle market CEOs in the U.S. are indeed pulling the trigger on new M&A deals in 2014, and they have the numbers to prove it. More than 1,250 new deals thru August topped last year’s 1,157 by 8%. And the total value of these deals exceeded 2013 figures by 12% topping $144Bil so far this year. But it should be better. So what’s behind why so many CEOs are still afraid of the dark? In 1923 University of Oxford Professor of Psychology George William Humphrey noticed a pattern interrupter in the way humans think and coined it “Humphrey’s Law.” The Law is simple, it states “…that consciously thinking about one’s performance of a task that involves automatic processing impairs one’s performance of it.” The typical application is in understanding athletic performance, but elsewhere like in many U.S. Boardrooms it’s called “analysis paralysis.” And despite evidence of an improving US economy, an improving labor market, the wealth effect from lower oil & gas prices headed into the 2014 shopping season, and a dozen other positive economic reports this past year, there still lingers far too many Scaredy Cat CEOs lurking in the shadows that should know better. Private Equity deals turning up the heat One reason for the hold-back used to be getting the financing to close a deal. That’s changed. Lending restrictions have loosened significantly in the past year and for many CEOs who see the opportunities ahead there’s no better time to make a deal. Leading the pack is Private Equity owned companies who recognize the low interest rate lending environment is just what the doctor ordered, an ability to fund a new deal at a low enough cost of capital to heat things up (See my recent CEO Magazine article: The M&A Market Is Heating Up. Is the Time Right to Make a Move?And not since 2007 has the cost of capital available for M&A deals been as affordable. The support comes from GF Data, who tracked middle market M&A activity in 2014 which shows a jump in demand for hybrid debt financings for Private Equity M&A transactions including “deals with uni-tranche financing.” So why is that important? Uni-tranche financing investment vehicles combine both senior and junior lending rates into a single debt product. These hybrid loans are considered riskier because they include a split between lower-rate secured (senior) and higher-rate unsecured (junior) debt instruments typically issued separately. Given more demand from deal makers, more banks are stepping up with more flexible loan products like uni-tranche loans to fill the gap in new deal financings. The result in effect helps to increase M&A activity, as noted, and quicken the pace of M&A deal flow across the board. The real trick is to recognize that there’s nothing to fear from the current M&A environment. Scaredy Cat CEOs can’t hide in the dark analyzing risk and market-trend data endlessly, whilst their intrepid competitors pull ahead in the months to come. Unlike S&P 500 companies with cash hordes still in excess of $1 Trillion, middle market companies don’t have the luxury of indecision any more, and must be more aggressive in the hunt for growth in this market. If Private Equity groups can continue to find ways to close more M&A deals, so too must CEOs of middle market companies step up and take a second look at the growing availability of deal financing options in an improving economic backdrop. At the very least consider if the damaging consequences and the paralyzing implications of Humphrey’s Law are working against you and/or the best interests of your shareholders. Have an objective discussion with your investment banker before year end. His job is to help you focus, take your foot off the brake and execute a real M&A strategy. Absent a plan of action Scaredy Cat CEOs who stay afraid of the dark this year might find themselves spooked out of a good M&A deal.

For some it’s a new day, for others the smell of fear lingers on more than 7 years past the Great Recession when life changed in America. Back then the pace of global M&A was approaching $4 Trillion, today it’s half that. But like all cycles long or short things come back around and when they do, it’s no time to hide behind a pumpkin in the dark. According to Mergers & Acquisitions News, many fearless middle market CEOs in the U.S. are indeed pulling the trigger on new M&A deals in 2014, and they have the numbers to prove it. More than 1,250 new deals thru August topped last year’s 1,157 by 8%. And the total value of these deals exceeded 2013 figures by 12% topping $144Bil so far this year. But it should be better. So what’s behind why so many CEOs are still afraid of the dark? In 1923 University of Oxford Professor of Psychology George William Humphrey noticed a pattern interrupter in the way humans think and coined it “Humphrey’s Law.” The Law is simple, it states “…that consciously thinking about one’s performance of a task that involves automatic processing impairs one’s performance of it.” The typical application is in understanding athletic performance, but elsewhere like in many U.S. Boardrooms it’s called “analysis paralysis.” And despite evidence of an improving US economy, an improving labor market, the wealth effect from lower oil & gas prices headed into the 2014 shopping season, and a dozen other positive economic reports this past year, there still lingers far too many Scaredy Cat CEOs lurking in the shadows that should know better. Private Equity deals turning up the heat One reason for the hold-back used to be getting the financing to close a deal. That’s changed. Lending restrictions have loosened significantly in the past year and for many CEOs who see the opportunities ahead there’s no better time to make a deal. Leading the pack is Private Equity owned companies who recognize the low interest rate lending environment is just what the doctor ordered, an ability to fund a new deal at a low enough cost of capital to heat things up (See my recent CEO Magazine article: The M&A Market Is Heating Up. Is the Time Right to Make a Move?And not since 2007 has the cost of capital available for M&A deals been as affordable. The support comes from GF Data, who tracked middle market M&A activity in 2014 which shows a jump in demand for hybrid debt financings for Private Equity M&A transactions including “deals with uni-tranche financing.” So why is that important? Uni-tranche financing investment vehicles combine both senior and junior lending rates into a single debt product. These hybrid loans are considered riskier because they include a split between lower-rate secured (senior) and higher-rate unsecured (junior) debt instruments typically issued separately. Given more demand from deal makers, more banks are stepping up with more flexible loan products like uni-tranche loans to fill the gap in new deal financings. The result in effect helps to increase M&A activity, as noted, and quicken the pace of M&A deal flow across the board. The real trick is to recognize that there’s nothing to fear from the current M&A environment. Scaredy Cat CEOs can’t hide in the dark analyzing risk and market-trend data endlessly, whilst their intrepid competitors pull ahead in the months to come. Unlike S&P 500 companies with cash hordes still in excess of $1 Trillion, middle market companies don’t have the luxury of indecision any more, and must be more aggressive in the hunt for growth in this market. If Private Equity groups can continue to find ways to close more M&A deals, so too must CEOs of middle market companies step up and take a second look at the growing availability of deal financing options in an improving economic backdrop. At the very least consider if the damaging consequences and the paralyzing implications of Humphrey’s Law are working against you and/or the best interests of your shareholders. Have an objective discussion with your investment banker before year end. His job is to help you focus, take your foot off the brake and execute a real M&A strategy. Absent a plan of action Scaredy Cat CEOs who stay afraid of the dark this year might find themselves spooked out of a good M&A deal.

CEO Business Outlook Survey for the rest of 2014 doc

As a Merger & Acquisitions Advisor to middle market business owners this year has been one of our hottest since 2007 in sheer numbers of owners looking to sell or raise money. I’ve written and spoken about why that is the case, but what are CEOs themselves saying about it? And why are so many middle market business owners still coming to market now?

The answers are this quick and concise study of CEO thinking conducted by Cohn Reznick to ask CEOs what they see and expect heading into the Fall and the rest of 2014…

See if you agree: Cohn Reznick CEO – Business Outlook Study – 2H 2014

——

It takes years to build trust and become your M&A Advisor… I hope this and other articles I can share with you bring us another step closer to that goal. Call anytime.

Thanks

Rick Andrade

Why Bank Lending is Up

According to the FDIC banks are adding more loans to their portfolios this year through the 2nd quarter. The 2.3% jump is the largest since the Great Recession started back in 2007.

The reason for the uptick is not just the obvious higher loan demand, lower loan loss reserves and a loosening of lending terms amidst historically low interest rates. More lending makes sense. It follows a long and growing list of US economic indicators in the last 6 months with telling signs of a better future including higher GDP forecasts, tighter employment rates, low inflation, and the increasing confidence displayed by CEOs and consumers to spend in the first half of 2014.

The biggest benefactor of more lending is likely to be small business owners whose time has finally come. So dust off your banker’s business card and give them a call. You may like what you hear.

Rick Andrade – Investment Banking

Read the article in the Wall Street Journal:

http://online.wsj.com/articles/u-s-banks-boosted-lending-in-second-quarter-fdic-says-1409234875

Why M&A is Red Hot this Summer?

It’s going to get really hot this summer. Southern California in summer; hot, dry, and happening. Despite rankings among the least friendly states to do business, when Californians get happy feet, the rest of the country starts jumping. That means as the velocity of money (spending) increases, the value of small businesses across the nation will increase as well, making for a hot summer and banner M&A activity this year. Why now? Here’s why;

Not since 2007, has the NFIB (National Federation of Independent Business) reported that their leading index of business optimism, the Small Business Optimism Index, topped 96 in May. While 96 is still below the Index’ historical average, it’s the trend that matters. And that trend is distinctively up so far this year. And while we’ve seen these uptrends before, this time is different. Famous last words if things don’t add up, but they do. Take a look.

The drivers of middle market business value is growth; sales growth, market growth, resource growth. And despite a frigid eastern winter which put the brakes on spending in Q1 with GDP contracting 2.9% in the US, and summer concerns over global conflicts and energy prices, for the moment at least, the economy is still projected to grow 3% or better this year. And the NFIB index projects that thinking.

Meanwhile, as the benchmark 10-year Treasury Note remains below 2.6%, research firm Factset reports Consumer Sector M&A topped $26B in the first 5 months this year, the hottest since 2008.

Climbing over a Wall of Worry, and in the face of potentially higher energy prices and job eliminating new technologies, employers are hiring more and firing less according to Dept of Labor reports this month. Consumers are feeling more confident, and signs of life and spending indicate US consumers awakening from what seems like a long Rip Van Winkle slumber and stepping up to spend again. And when the trend is your friend you stick with it, especially when in good company. The S&P and Dow indexes both continue to make new all-time highs in May and June with no signs or reasons to abate just yet. The VIX (S&P Volatility Index or “the worry gauge”) is under 12, far below the 60 high mark it hit in October 2008 during the height of the Great Recession.

So how long will this market frenzy last? And what does this mean for business owners in the middle market?

An increase in CEO Confidence is likely the most fundamental and significant leading indicator of expansion. And it’s not a data silo of one or two points either. There are many. According to S&P IQ research US companies are able to borrow more than at any time during the last 7 years. Senior debt multiples (Debt/EBITDA) could top 5x this summer. The previous high was 4x and even less during the recession. Not since 2007 have banks given such leeway. Banks have also loosened formerly more restrictive covenants. Today’s covenant-lite issuers are finding they have to compete more for quality loans, hence the easing (see the article in Mergers & Acquisitions). Covenant-lite loans open the door for more lending by allowing new borrowers access to more third-party debt, higher leverage ratios and lower interest-coverage ratios. When businesses can borrow more for less they tend to invest the additional capital in capital projects, stock buy-backs, dividends and M&A. And the sharp increase in M&A activity in Q1 2014 as noted supports that trend.

Private equity funds in the meanwhile, are still looking to find and invest in high-quality solid cash flow companies and are paying up big time. According to Factset M&A buyout deal premiums for the last three months ending May 2014 topped 56%. That’s a whole lot of over-paying in my view.

Still, with increasing competition across most business sectors and economic drivers reflecting higher GDP growth for the balance of this year, when added together the billions of bucks on the books of S&P 500 companies and Private Equity Funds are enough to continue to fuel the flames of a market on fire. And as more buyers seeking high-quality assets compete and bid prices up, like a prime cut of beef, when it’s gone, buyers tend to work their way down the slab. That’s the trickle-down effect as cycles go. They go up, they go down. And while it’s always too risky to time the ups, it’s also too risky to look a gift horse in the mouth.

My point in this summer bulletin is simple. Add all these data points and index measures together and the 2014 uptrend is clear. Increasing confidence, increasing demand, increasing consumer spending all translate into increasing valuations for small and middle market businesses this year. So if you’ve been waiting to enter a better market to sell or buy a business, evaluate your options carefully as the heat of summer looks pretty cool for the middle market this year.

US Census Reports – Baby Boom Bubble

Check out the attached Baby Boomers – 2014 US Census release. It’s an important study of the Baby Boomer population in the US from its peak of 77 million in 2012 to less than 2.5 million in 2060. As a part of this trend, if you are a Baby Boomer like me this study is a real eye-opener. Especially for business owners who are collectively headed for some big demographic changes in the next few years. So what should you do?

Well, as more business owners begin the hunt for buyers in the next 3-5 yrs, a key successful selling factor is likely to favor those SMBs with more diverse customer/product channels.

This emphasizes the need to have (or develop) a broader Value Proposition for growth, as potential buyers will seek to pay premiums for those more diverse global business players.

Best advice?

Read the report. Then decide how closely you want your business products and services to closely align with this Baby Boomer bubble. Just one thing. As time goes by… beware the law of diminishing returns.

Until then…I am always happy to hear from you… And please remember to forward any clients that may need some friendly buy/sell advice. It’s always free.

Thanks,

Rick

M&A 2014 Outlook

Why Lenders Say No

Eh! It’s 2014: Show me the Money, Jerry

February 13, 2014 • Rick Andrade • Print

published: Vistage for CEOs

“Show me the money,” shouts a screaming football player (played by Cuba Gooding Jr) into the phone to his sports agent Jerry Maguire (played by Tom Cruise) in the movie. The scene is forever classic, like “Greed is good” in the movie Wall Street. But here, Jerry must bellow back the phrase over and over to salvage Gooding (his last remaining client) from jumping ship.

While it may be hard to recall the exact year that movie was released, the line and message has never lost its popular refrain. Show me the money. That’s still the big question I hear in these early days of the New Year from small business owners sensing it may be safe to invest in the future again.

While the economy hints at really blasting off in 2014, a new hope for better times ahead is finding its roots in many quarters of the economy, according to economists like Mark Zandy at Moodys. Zandy sees the December labor report which showed only 74,000 new jobs created as a flute, and sites a 4% GDP run-rate in Q4 of 2013, coupled with a 30% increase in the S&P stock index last year, as too bullish to ignore.

To these enthusiasts, 2014 is finally the year to Show me the Money. Translation; we should expect more growth, more demand, more jobs, and less government intervention. But I can recall a year ago January 2013 when much the same enthusiasm lauded 2013 as the break out year. But while the stock market (courtesy of the Fed) added 30% gains, money lenders and investors showed only a weary confidence. So why should we believe now 2014 is the new 2013?

As a natural born sceptic, always on the alert, I tend to look for signs that the engine that drives our economy is truly gearing up, which means more specifically, not looking at employment figures up or down each month, but rather taking a closer look at small business lending metrics as a leading indicator, in other words checking the horse behind the horsepower. Companies who borrow do so because they see a profitable reason for doing so.

Still, from the executives I speak with, as a business and banking advisor, comes a repeated chorus of rhythm and blues as to why banks still won’t lend to them. But the reality, according to the Federal Reserve October Bank Lending Survey, is different. “Regarding loans to businesses….banks eased their lending policies” and sited an increase in demand and competition for such loans. The market for business loans and equity capital funding has been quietly fertilizing the landscape for small business growth for months now, which I believe is why the stock market and economic forecasts look so much more promising.

If the trend continues as expected, Show me the Money for businesses large and small will flow like the river Nile in 2014. In fact, a recent KPMG survey of 1000 business execs found 2 out of 3 (66%) are looking for new opportunities to expand in 2014, including in my space, bringing buyers and sellers together in M&A.

Like no other time in history, access to capital is global. What’s more, while the landscape of capital providers continues to change, competition among money lenders and investors is expected to heat up this year as idle cash seeks solid investment opportunities. What’s especially good about 2014’s ability to really Show me the Money is a consequence of the JOBS Act two years earlier. New SEC rules now allow more general public solicitation for investments formally excluded, which opens wide the capital flow spickit even more than in 2013, making it easier for private equity funds, hedge funds, and even venture capital rounds to advertise and raise money via the internet.

Add to that, courtesy of Title III of the JOBS act, Crowdfunding, which connects small business and/or entrepreneurs with like-minded investors online using social media. This new funding platform has already topped $5bil in deal activity last year according to www.crowdfunding.org, and in my view will soon compete aggressively and openly with Angel and Venture Capital group money.

Which brings me to the key question I am often asked: “If there is so much money, where is it? “

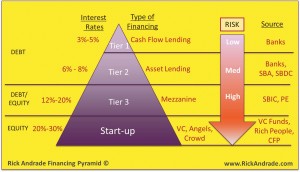

Enter the Rick Andrade FINANCING PYRAMID, a simple graphical way to visualize how lenders and investors categorize and link risk to rates. I recently discussed a version of my Pyramid as a speaker at the Fancy Food Show in San Francisco this year. I created the Financing Pyramid because it helps explain why applications for loans or equity get rejected. Here for the first time business owners and execs can see how banks and investors will likely view applicants when they ask for cash. And unless your company is a Tier 1 borrower, the unexpected higher interest rates quoted can be hard to understand. Why?

The simplest answer when clients ask what rate a lender or investor will charge is to know what risk they are taking: the lower the risk the lower the rate. Have a look at the Pyramid again. Interest rates listed are near-term ranges from surveys and vary according to the applicants perceived risk profile; like home mortgage loan rates that can vary based on your credit score.

On the right hand side of the Pyramid are the sources of financing like commercial banks, small business investment companies, private equity, angels and even crowdfunding. This is where so many execs get confused and often shocked out of the market when they approach a source for money. They hear about low rates and abundant capital, but don’t know in advance which Pyramid layer (interest rate group) their application will fall, or should fall: Hence why I created the Pyramid.

In Tier 1, top earning cash flow businesses which are mostly mature, profitable businesses looking to borrow funds to expand via M&A, build new plants and buy new equipment get the best deals because the risk of repayment default is low. That’s easy, right? But higher risk Start-ups on the other hand, trade risk for reward more starkly. In 2014, rates for HIGH RISK start-ups will likely stay in the 30-40% range, where they have been historically, because the risk of default is most often very high.

50% of all new start-ups will fail within 5 years according to the BLS. For this reason, banks and other lending institutions want collateral and security for defaults. Enter Tier 2, where lenders look for assets and accounts receivables to collateralize in the absence of abundant cash flows. These Asset Based Lenders, and hard money finance companies like On Deck, Biz2credit, and CAN Capital to name a few charge hefty fees, as high as 50% annualized, according to the Wall Street Journal (1-8-14, 2014).

Still without such collateral the risk of default climbs even more in the eyes of many money sources. And at Tier 3 & 4 (Start-Ups), it’s hard to fill the void. Family, Friends, Angels, Credit Cards, these old traditional sources of funds have not changed in decades. And rates for these funds, in some cases 40% or more, may even require business owners to use the equity in their business in exchange for the cash.

The take-away message here is that while investors and lenders have more Show me the Money capital on-hand ready to deploy now than at any time since the great recession ended. 2014 still requires the responsibility of business owners and cash-seeking executives to calculate their own risk profile. Do the research and peg your risk profile with those on the Financing Pyramid.

When you do that, you will have at the very least a basis of understanding for why lenders and investors when they do Show you the Money, will charge you, not the advertised media headline super low promotional rate, but rather the rate that matches the reality.

In Finance

Employees: Are They Worth It?

So I wrote about it and published it at Vistage Village, where it is generating a lot of buzz about where CEOs stand when it comes to people vs technology.

Here’s the article: BY Rick Andrade, Los Angeles, Ca

It’s 5:00am Monday morning and you’re at the office early because today you’ll need all hands on deck. Your largest customer is expecting on-time delivery today and you hope everyone on staff shows up. But they don’t. Four label & pack clerks have the flu. It’s the third time this month. You throw up your hands, pull up your sleeves, and get packing. You recall reading an article in Automation Nation Magazine about new worker productivity machines. Hmmm… But you still love having employees, right?

Sound familiar? It seems to me that as 2014 looms on the horizon, most business owners are not only reading more articles, but also buying into options to do more with less. And that’s not good for human beings looking for work if you follow me. Why? Because Human labor is a really tough hire these days, especially as demand improves. According to the US Labor Dept., Worker Productivity (the value of goods and services produced in a period of time, divided by the hours of labor used) has doubled in the last 40 years, and combining that with Outsourcing means employers have serious alternatives to hiring US workers to get the job done; which begs the old question anew; Are employees worth it?

Of course part of the answer is related to how a business owner perceives the Value of an employee. As a result, I thought now was a good time to take a closer look at how we got here.

To frame the discussion, the Value of an employee is clearly both quantitative and qualitative in measure. If you ask a Wall Street Analyst the value of your employees, he or she will say that’s easy. Take your total annual sales and divide that by the number of employees you have, and Bingo! That’s the value. The higher the ratio of sales to staffer, the more valuable each employee should be to the enterprise. The lower the figure the less valuable and less productive to the enterprise each staffer is. This is called the Sales per Employee ratio (SPE), and it can vary a lot depending on your industry:

Sales Per Employee (SPE) Ratio

SPE is one of the most widely used performance metrics to measure the value of staffers to total revenue. For example, Wal-Mart with $450bil in annual sales as of 2012 and over 2 million employees has a $214k per staffer SPE metric, while service industry employees like those at Morgan Stanley with $34bil in sales and 57,000 employees in 2012 generates $598k in sales per staffer. Facebook meanwhile generates $5bil in revenues with just 4,600 employees according to filings. That’s over $1.3million per human there. From a stock market point of view, a firm with a higher SPE ratio over its competition should have a higher overall valuation, all else being equal. In fact, companies that outsource manufacturing to a lower cost domicile (think China and India) can also increase its SPE ratio, and hence market value for shareholders. Take a look at this table and see if you can spot a pattern:

SPE Ratios for select companies: 12months Ending June 2013:

Company …………………………..Sales per Employee

Exxon Mobil:………………………….$ 5,801,756 FaceBook:………………………………$ 1,324,529 Microsoft:………………………………$ 828,181 GM:………………………………………$ 717,568 Morgan Stanley:………………………$ 598,570 Intel:……………………………………..$ 498,333 Boeing:………………………………….$ 476,021 Kraft:…………………………………….$ 430,897 B of A:……………………………………$ 372,322 Walt Disney:………………………….$ 283,686 Wal-Mart:……………………………..$ 214,991 McDonalds:……………………………$ 63,167Of course these figures can be misleading and don’t illuminate the full picture. But in general with the exception of Exxon Mobil, higher SPEs come from higher technology companies’ output. These companies are very productive at what they do. But even in manufacturing, higher technology often translates into doing more with less. Take auto manufacturing. In 1993, GM generated $110bil in US auto sales with 448k employees which equals a $245k SPE. Today GM sales are $153bil with 213k staffers resulting in a $717k SPE, almost 3 times the value per worker as compared to 20 years ago. So how did GM nearly triple its worker productivity in the US? One word: Robots.

Productivity in the US

According to the Heritage Foundation and US labor statistics, Worker Productivity in the US has doubled since 1973. That’s a 100% increase in 40 years. Consequently, one employee today can now do the work of 2 staffers 40 years ago. While this massive productivity wave continues to spread across all business sectors in the economy it technically suggests American businesses only need one-half the workers to produce similar goods and services. Along the way this tends to wipe out unskilled labor in the wake, and can turn many full-timers into part-timers. In fact, the NY Times reported 70% of jobs created through June 2013 are indeed part time. As employers seek increasingly higher skilled human beings this trend further decreases the US Labor Force Participation Rate (those working and looking for work), which stands at a record low 63% in August 2013, down from 66% in 1993 according to the Bureau of Labor Statistics. Part of the reason for the decline is the growing number of unskilled or mis-skilled workers who can’t find work. And this gap is a problem.

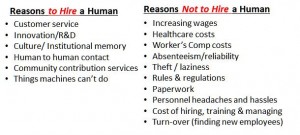

But let’s be fair. If as an employer you had the choice between human or machine, which should come out on top? That’s easy, right? Grab a pencil and try it. Make a quick list, 2-columns: Reasons to Hire, Reasons Not to Hire. Click on my list:

Now ask yourself, given the choice man or machine, which is better?

In other words as the cost of finding and hiring and training and managing a human being on the planet in any “for-profit” business increases, why would an employer in a competitive market be compelled to do it? In a free market they wouldn’t. But is the pendulum of technology swinging past its own purpose? Some anti-free-market socialists might argue there should be a regulatory obligation by employers of ‘size and capability’ to hire and maintain a specific number of staff? They cite that in 1973 S&P 500 earnings per share (EPS) was $40, as of mid-year 2013 S&P EPS is nearing $90. And while even in times with very little top line revenue growth, S&P 500 companies continue their climb by cost cutting and productivity increases. So where does this end, The Matrix? As the landscape changes and our economy becomes one driven more by ‘knowledge workers,’ fewer and fewer are needed. Hence the gap between man and machine could threaten the entire US economy where 70% of US GDP is driven by consumers spending their hard earned cash one job at a time.

So are employees still worth it? If you’re an employer in the U.S. it’s your choice; hire a human and take the plunge, or instead hire a tireless metal monster or digital demon and add to our nation’s increasing Productivity rate. That is, a technology pendulum that I estimate could feasibly replace as much as 30% of the remaining U.S. workforce by automating or outsourcing jobs in the next 20 years.

So whether or not the value of your employees is measured in sales or service or love of human interaction, each business owner will continue to face the difficult choice of man or machine as an individual decision. But if nothing is done to ebb the flow of automation without a concern for the human part of the equation, we may all accidentally find ourselves online buying that fancy new can-opener robot on sale that also cleans windows, walks the dog, and does our taxes. Think about how much money that could save your old employees, once they find a new job.

About the author: Rick Andrade is an investment banker and finance writer in Los Angeles helping CEOs buy, sell and finance middle market companies. Rick has earned his BA and MBA from UCLA along with his Series 7, 63 & 79 FINRA securities licenses. He is also a Real Estate Broker, a volunteer SBA/SCORE instructor, and blogs at www.RickAndrade.com on issues important to middle market business owners. He can be reached at rickandrade@earthlink.net. This article should not be considered in anyway an offer to buy or sell a security. This is for informational purposes only.

Webinar: The Transaction of a Lifetime – Strategies for planning the sale of your business

I had the honor of participating on a recent webinar panel with 3 other guest speakers discussing how and why business owners should pre-plan their exit before they sell their most valuable asset.

Click on the link below for a Free copy and hear from experts on the subject as well as my take on the difference between Price and Valuation Multiples.

Here was the agenda:

– Creating a Check List is your first move – Pre-planning (>2 yrs before transition) – Short term planning (<2 yrs before transition) – Exit strategy – How to execute the planWho attended:

CEOs, CFOs, business owners and advisors

The Panel:

Rick Andrade, Managing Director – Janas Associates M&A Investment Banking firm Andy Horowitz, VP with Morgan Stanley Wealth Management Ronald S. Friedman CPA Partner with Marcum LLP Lewis Stanton, Managing Partner at Stanton Associates LLC Audio:http://lighthouseconsulting.org/openline/091013/OpenLine091013.mp3

Slides:

http://lighthouseconsulting.org/openline/091013/OpenLine091013.pdf

ObamaCare is Coming – Free SBA Webinar – Explains the Latest News

After years in the making, this coming October 2013 marks the beginning of the roll-out of the Affordable Care Act, aka ObamaCare. Given the sweeping changes of the new law much mis-information and media hype trying to explain it has only fueled the flames of confusion and distrust as to what actions small business owners must take. Congressman Waxman’s office recently offered to help by sending me a link to the SBA which is now conducting Free Webinar updates on their website to help clarify employee vs employer impacts starting this fall.

The SBA is offering several Free LIVE Webinar opportunities so business owners can ask questions and get answers. Here’s the link http://www.sba.gov/community/blogs/community-blogs/health-care-business-pulse/affordable-care-act-101-weekly-webinar-se

Remember the “employer mandate” component of the law has been postponed 1-year to January 2015. Meaning businesses with more than 50 employees will have one more year to prepare to offer health insurance to their employees. Recall the actual number of small businesses with more than 50 employees that currently DO NOT offer health insurance is below 5% nationally. So for the vast majority of small businesses in the U.S. nothing will change.

The “individual mandate” on the other hand, will roll-out this fall as scheduled, unchanged by the 1-year delay. That means by January 2014 uninsured Americans en masse will be expected to participate in the market by purchasing healthcare insurance on the new state Healthcare Exchanges popping up across the country. For those in California the new H/C exchange is called www.CoveredCalifornia.com

Given this new law will likely impact you or somebody you know, aka your employees, I suggest each CEO get better educated on the subject before employees come asking about their options. These new SBA Webinars as a result offer an easy opportunity to get up to speed quickly.

Rick